The Four Lenses That Actually Explain the Market

Why price moves when headlines don’t — and what traders should really be watching

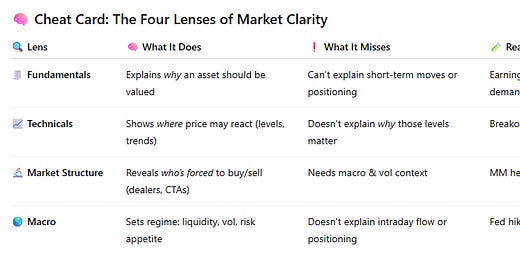

🧠 The Four Lenses of Market Clarity

Why most investors see noise — and how to start seeing real supply and demand

Ever watch CNBC and think, “Weren’t we bullish yesterday?”

One minute it’s “Tech surges on AI optimism,” the next it’s “Recession fears spark selloff.” Then someone pulls up a chart and starts drawing trendlines — or pivots to bond yields like that’s the thing that suddenly explains it all.

Most investors are stuck reacting to headlines, charts, and vibes, trying to reverse-engineer a reason for what just happened. But real traders know the market isn’t driven by opinions — it’s driven by flows.

And the market doesn’t move just because people are bullish or bearish.

It moves because of supply and demand — often shaped by structural and mechanical forces that determine who has to buy or sell next.

But here’s the nuance:

It’s not just “supply and demand” in general.

It’s the incremental supply or demand that moves price — and that often comes from market maker hedging, CTA flows, or systemic rebalancing events like OPEX.

So why does price rise on bad news? Or fall after an earnings beat?

Because most of the time, it’s not the story — it’s the structure.

Let’s break down the four lenses the pros use to decode price action — and why layering them gives you clarity when others are chasing headlines.

1. 🧾 Fundamental Analysis – The Narrative Lens

This is what most investors are taught first.

Earnings reports. GDP. Central bank policy. Valuation multiples.

Fundamental analysis is the world of “what should happen,” based on financials, forecasts, and economic logic. It tells us why a stock should go up… but not when, or how much, or what stands in the way.

✅ Strengths: long-term conviction, thematic positioning, macro context

⚠️ Blind spots: can’t explain short-term volatility or mechanical price pressure

🔁 Example: A company beats earnings, raises guidance… and the stock drops.

→ Why? Because everyone was already long. No new demand = no price lift.

Fundamentals explain potential energy — but not how or when it converts to movement.

That requires flow.

2. 📈 Technical Analysis – The Price Map Lens

Charts give traders a visual roadmap. Support and resistance. Moving averages. Patterns. Trendlines.

This is the realm of crowd psychology made visible. Where did people act before? Where might they act again?

But TA has a major flaw: it shows where people might act — but not why.

A level can hold or break based on hidden positioning and structural flows that aren’t visible in the chart.

✅ Strengths: timing entries/exits, defining risk, visualizing sentiment

⚠️ Blind spots: doesn’t account for vol, dealer positioning, or hidden supply/demand

🔁 Example: Breakout fails and reverses hard. Not because the chart lied — but because a gamma wall above added supply pressure no one saw on the chart.

Technical analysis is necessary — but not sufficient.

It gives you levels. But without context, it can’t tell you whether those levels are cliffs or stepping stones.

3. 🔬 Market Structure & Flow – The Real-Time Supply/Demand Engine

This is where the modern market lives.

Forget opinions. Forget forecasts. The real driver of price is forced flows — and the incremental supply or demand they create.

It’s not about who wants to buy.

It’s about who’s forced to buy — and when.

Let’s break it down:

🏦 Market Makers (MMs) hedge customer flow. When traders buy calls, MMs get short delta and must buy the index or stock to hedge. That creates new demand mechanically.

→ This hedging flow is often the primary driver of intraday direction.

→ When positioning is lopsided, MM hedging becomes the largest source of incremental flow.📊 CTAs (Quant Trend Followers) use price-based rules to scale in or out of positions. A 20-day high? Add longs. A breakdown below the 50DMA? Cut risk.

→ These flows often lag — but when they flip, they move size. It’s not opinion — it’s programmed supply/demand.💵 Corporate Buybacks are scheduled, repeatable bid flows. Especially in low liquidity environments, they act like price floors that few understand — but many benefit from.

🔁 Volatility Cycles & OPEX create seasonal patterns. When options expire, dealer hedging resets. When vol collapses, dealers reduce protection. This creates predictable shifts in net supply/demand.

And finally…

🏗 Macro Plumbing.

Fed policy doesn’t just “set the tone” — it determines where $6 trillion in cash can go.

When the Fed hikes and MMFs pay 5%+, institutional money stays parked.

When rates fall or liquidity is injected, cash has to find a home — and risk assets feel the bid.

This isn’t guesswork.

It’s structure.

And it’s measurable.

This is the lens I rely on most in the $SPX Road Map — because it explains what TA and fundamentals can’t:

Why price is moving right now.

4. 🌎 Macro – The Liquidity Engine Behind Risk and Regime Shifts

Macro doesn’t move price minute-by-minute, but it sets the rules of engagement.

It determines how much liquidity is available, what the opportunity cost of risk is, and how sensitive the system is to shocks.

Think of macro as the lubricant of the entire market engine:

When liquidity is abundant, everything flows smoothly.

When it’s tight, even small imbalances grind the machine.

It also controls the volatility backdrop. When volatility is high, flows behave differently — and when liquidity is scarce, even small imbalances cause big moves.

✅ Strengths: identifies regime shifts, policy pivots, volatility pricing

⚠️ Blind spots: difficult to time precisely; doesn’t explain intraday mechanics

🔁 Example: A soft CPI print doesn’t just signal disinflation — it can collapse vol, trigger mechanical flows, and flip the entire market into risk-on mode

Let’s drill down:

When Powell cuts rates, it’s not just “stimulus.”

It’s a direct blow to the appeal of short-duration cash vehicles — forcing yield-hungry institutions back into risk assets.When the Fed holds rates high, $6+ trillion in MMFs and T-bills stays parked — starving the market of new buyers.

Meanwhile, heavy Treasury issuance (especially beyond MMF absorption capacity) can force yields higher even without rate hikes — draining liquidity and putting pressure on equities.

So while macro doesn’t explain why SPX bounces off 5120 or stalls at 5285, it does explain why there’s less liquidity to absorb a 2% move — or why vol explodes on what used to be a “meh” data print.

🛣 Macro sets the road conditions

🚗 Liquidity is the traction

🧭 Structure determines the steering

🧭 Why This Framework Matters

Most traders — retail and institutional — still try to trade narratives.

But the market doesn’t care about your story.

It cares about who’s offside, who’s hedging, and where forced flow shows up next.

This is the difference between watching the weather and understanding the tide.

It’s not about guessing right.

It’s about knowing where pressure is building.

That’s the real cheat code.

🎥 Join me live at 8:30 AM ET for SPX prep and market structure breakdown:

YouTube: https://www.youtube.com/@DocMcGraw

X (Twitter): https://x.com/doc_mcgraw

Tap in for levels, flow, and scalping setups.

—

Doc McGraw / Options Gelt

🔗 https://www.substack.com/@tradermcgraw331292

An excellent review of the world we live in.

Great insights. Thank you!